Here’s the answer to this week’s reader question.

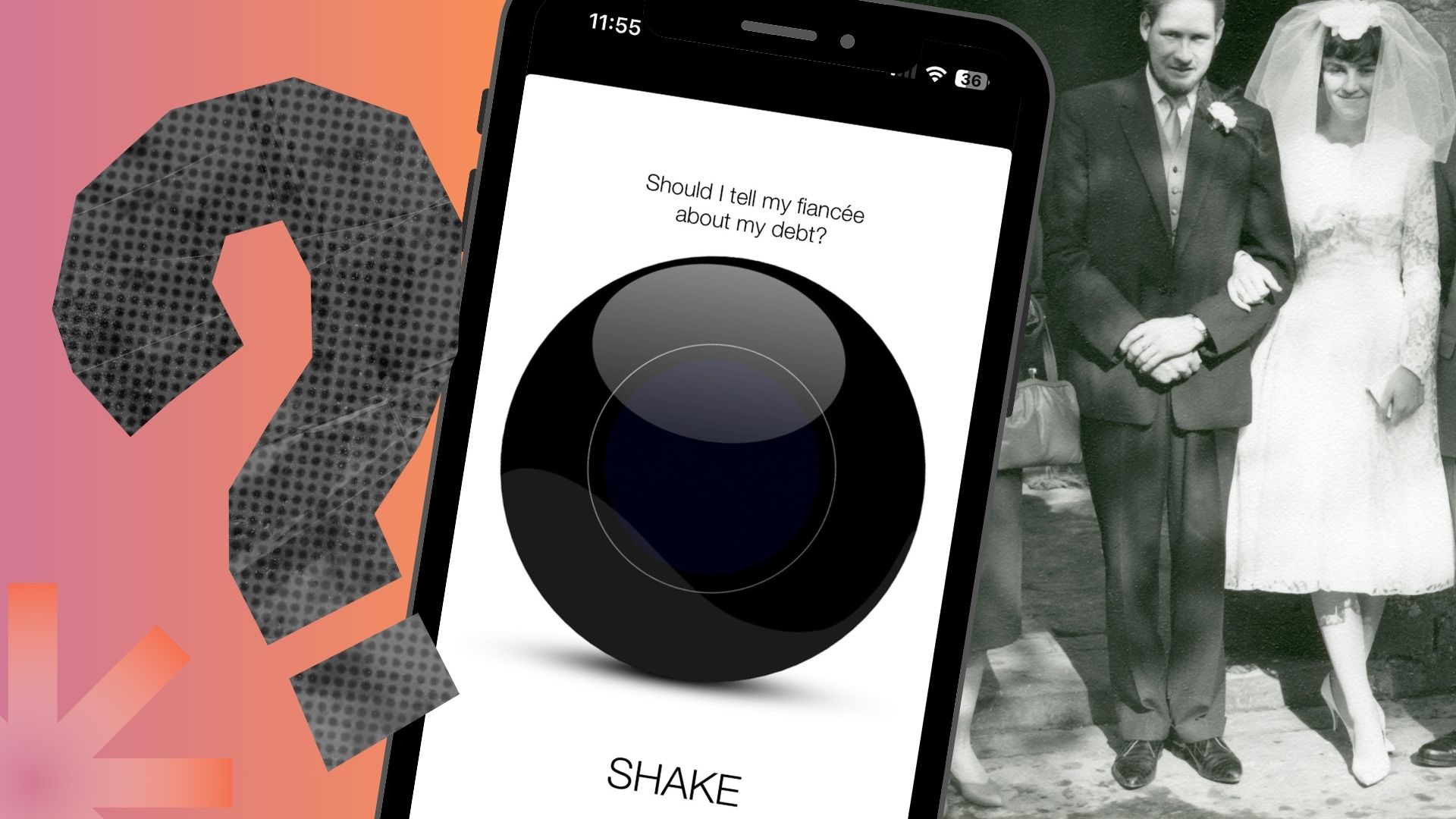

“If I marry and have a lot of debt, does that debt also become a burden on my new spouse?”

—Stephen

Have a question for us? Send it to TheGet@neofinancial.com.

In Canada, are debts shared in marriage?

The short answer: your debt doesn’t automatically become your partner’s responsibility when you get married. If you took out a student loan or had a credit card when you were single, and you signed that agreement on your own, that debt is just yours.

The long answer: yes, your debt can have an effect on your spouse.

On a financial level, for instance, if a lot of your income is going to debt payments, you’ll be less able to contribute to your household’s rent or mortgage, which may affect where you and your partner can live.

Having a lot of debt can affect your ability to borrow more money. You may have difficulty taking out a joint car loan or joint mortgage, because a lender will look at you and your partner’s overall debt load. And in this scenario, both credit scores will be taken into account.

Beyond the financial impact, if you’re bringing debt into a marriage, that’s going to emotionally affect your relationship—especially if it’s news to your partner.

I don’t love the word “burden,” which is very emotionally charged. But entering a marriage while carrying debt can be very stressful. Even if your partner doesn’t legally have to pay off your debt, there’s still an impact on your relationship.

So, have that conversation as soon as possible, certainly before the wedding. If you don’t, it’s natural for your partner to feel like you weren’t being quite honest about your situation and yourself.

I’d recommend you be really clear about what led you to being in debt, and be upfront about the scope of the debt. Be ready with numbers. And then let your partner know your plan to pay it off.

There are some really great resources that can help you make a plan. For example, PowerPay is a debt reduction tool from Utah State University. I love it because it’s so easy to use and it’s free. It lets you input all your creditors and it generates a payment plan, month by month. And it gives you a date when you’ll be all paid off.

Finally, if you have shame or guilt about the way you deal with money, consider booking an appointment with a certified financial counsellor (CFC) to tackle any behavioural or emotional issues that led you into this situation. They can help you improve your financial well-being through better money management, behavioural counselling and financial literacy. And talking to a CFC is also a great way to show your partner, “I’m working on this.”

—Wendy Underwood

Founder, Lifeform Financial Coaching

As told to Wing Sze Tang

Wing Sze Tang is an award-winning journalist based in Toronto. She is the founder of Wayword Media Inc.

Read more from this issue of The Get:

- True or false: You’ll save more when you earn more

- MVP: Emily The Recruiter on quitting for good (and other work-related stuff)

- The sober saver trend: How much drinking can cost you

- Do you pay yourself first?

-----------------------------------------------------------------------------------

The Get is owned by Neo Financial, and the content it produces is for informational purposes. Any views expressed are those of the individual author and/or of The Get editorial team., not of Neo Financial or any of its partners or affiliates. The content is not meant to replace professional financial advice, and it should not be the sole source for making any financial decisions. Always do your due diligence before deciding what to do with your money. Read The Get’s editorial mandate.