Neo blog

Make your money work smarter with Neo Financial. Learn about saving, smart spending, credit building and more on our personal finance blog.

Recommended for you

Here Are 2 Alternatives to Nyble's Credit Building Loans That Actually Work

"The question, with credit building micro-loans, is whether the credit bureaus recognize them as being something that is worthwhile and do the lenders that see that data as something useful."

5 Ways to Rebuild Your Credit After a Consumer Proposal

A consumer proposal will drop your credit score by roughly 100 to 150 points and place an R7 rating on every account included in the filing. That notation stays on your TransUnion report for six years from the filing date or three years after complet

The Truth About Instant Acceptance Credit Cards in Canada

That means a card advertised with instant acceptance is not necessarily easier to get than one that takes five business days. The approval criteria, including your credit score, income, and existing debt obligations, still determine the outcome.

Five Bankruptcy Alternatives For Canadians Struggling With Debts

Canadians who owe more than they can repay have at least five viable bankruptcy alternatives that can reduce payments, lower interest, or settle debts for less than the full amount.

You Can Take Out a Payday Loan During a Consumer Proposal, But Don't Do It

Any new payday loan you take out during a consumer proposal will not be covered by that proposal, meaning you will owe the full amount plus interest on top of your existing repayment plan. You also risk breaching the legal rules that govern consumer proposals, which can carry real consequences with your Licensed Insolvency Trustee and your creditors.

How to Apply for a Credit Card Without Hurting Your Score in Canada

"When you first apply with Neo, we're only doing a soft check and we will use that to tell you what product you qualify for before we do the hard check."

Here Are 2 Alternatives to Nyble's Credit Building Loans That Actually Work

"The question, with credit building micro-loans, is whether the credit bureaus recognize them as being something that is worthwhile and do the lenders that see that data as something useful."

5 Ways to Rebuild Your Credit After a Consumer Proposal

A consumer proposal will drop your credit score by roughly 100 to 150 points and place an R7 rating on every account included in the filing. That notation stays on your TransUnion report for six years from the filing date or three years after complet

The Truth About Instant Acceptance Credit Cards in Canada

That means a card advertised with instant acceptance is not necessarily easier to get than one that takes five business days. The approval criteria, including your credit score, income, and existing debt obligations, still determine the outcome.

Five Bankruptcy Alternatives For Canadians Struggling With Debts

Canadians who owe more than they can repay have at least five viable bankruptcy alternatives that can reduce payments, lower interest, or settle debts for less than the full amount.

You Can Take Out a Payday Loan During a Consumer Proposal, But Don't Do It

Any new payday loan you take out during a consumer proposal will not be covered by that proposal, meaning you will owe the full amount plus interest on top of your existing repayment plan. You also risk breaching the legal rules that govern consumer proposals, which can carry real consequences with your Licensed Insolvency Trustee and your creditors.

How to Apply for a Credit Card Without Hurting Your Score in Canada

"When you first apply with Neo, we're only doing a soft check and we will use that to tell you what product you qualify for before we do the hard check."

Credit

View All

The Truth About Instant Acceptance Credit Cards in Canada

That means a card advertised with instant acceptance is not necessarily easier to get than one that takes five business days. The approval criteria, including your credit score, income, and existing debt obligations, still determine the outcome.

You Can Take Out a Payday Loan During a Consumer Proposal, But Don't Do It

Any new payday loan you take out during a consumer proposal will not be covered by that proposal, meaning you will owe the full amount plus interest on top of your existing repayment plan. You also risk breaching the legal rules that govern consumer proposals, which can carry real consequences with your Licensed Insolvency Trustee and your creditors.

How to build credit: Grow your credit profile in Canada

Learn practical steps to help build your credit score, understand how credit works, and take control of your financial path in Canada with confidence.

The Truth About Instant Acceptance Credit Cards in Canada

That means a card advertised with instant acceptance is not necessarily easier to get than one that takes five business days. The approval criteria, including your credit score, income, and existing debt obligations, still determine the outcome.

You Can Take Out a Payday Loan During a Consumer Proposal, But Don't Do It

Any new payday loan you take out during a consumer proposal will not be covered by that proposal, meaning you will owe the full amount plus interest on top of your existing repayment plan. You also risk breaching the legal rules that govern consumer proposals, which can carry real consequences with your Licensed Insolvency Trustee and your creditors.

How to build credit: Grow your credit profile in Canada

Learn practical steps to help build your credit score, understand how credit works, and take control of your financial path in Canada with confidence.

Spending

View All-noZ7EWjRU9dKiBNDc0ZBel0LonqVUs.png&w=1920&q=75)

Why the holidays are the season for scams—and how to avoid them

Don’t become a victim; be aware of common holiday scams. It may help you protect yourself, your sensitive information and your money.

How do credit cards work? The ultimate credit card guide for beginners

Everything from applications and utilization to limits and payments

What is inflation and whats next?

Inflation is a daunting topic that brings many unpleasant feelings. We’re here to help you understand what inflation is, what to look out for, and what you can do.

-noZ7EWjRU9dKiBNDc0ZBel0LonqVUs.png&w=1920&q=75)

Why the holidays are the season for scams—and how to avoid them

Don’t become a victim; be aware of common holiday scams. It may help you protect yourself, your sensitive information and your money.

How do credit cards work? The ultimate credit card guide for beginners

Everything from applications and utilization to limits and payments

What is inflation and whats next?

Inflation is a daunting topic that brings many unpleasant feelings. We’re here to help you understand what inflation is, what to look out for, and what you can do.

Budgeting & Debt

View All

Neo’s declassified financial survival guide for your 20s

Find answers to your top questions about personal finance in your 20s. We focus on the top 9 goals you should aim for to set yourself up for success

Understanding debt

Learn simple, straightforward debt management strategies that will enable you to fully understand and manage your debt, while providing you with peace of mind.

How Much Money Should I Have Saved by 30?

Not sure how much money you should have saved by the time you're 30? We give you tips and advice on budgeting, saving, and building wealth. Get started today!

Neo’s declassified financial survival guide for your 20s

Find answers to your top questions about personal finance in your 20s. We focus on the top 9 goals you should aim for to set yourself up for success

Understanding debt

Learn simple, straightforward debt management strategies that will enable you to fully understand and manage your debt, while providing you with peace of mind.

How Much Money Should I Have Saved by 30?

Not sure how much money you should have saved by the time you're 30? We give you tips and advice on budgeting, saving, and building wealth. Get started today!

New from Neo

View All

3 tips for first-time homebuyers in 2023

Reduce stress when buying your first home by better understanding the process, and use these three tips from Treadstone Law to reach homeownership like a pro.

Neo Financial Teams Up with CEBL

The Canadian Elite Basketball League (CEBL) is partnering up with Neo Financial™, a leader in Canada’s financial tech industry.

Strengthening our senior leadership team at Neo Financial

We are thrilled to share the appointment of several new senior leaders at Neo. Please join us in welcoming Amanda Broos as Chief People Officer, Dana Saric as Chief Legal Officer, Allemander Neto as Acting Chief Financial Officer, James Nauss as Chief Operating Officer, and Stefan Doan as Chief Information Officer.

3 tips for first-time homebuyers in 2023

Reduce stress when buying your first home by better understanding the process, and use these three tips from Treadstone Law to reach homeownership like a pro.

Neo Financial Teams Up with CEBL

The Canadian Elite Basketball League (CEBL) is partnering up with Neo Financial™, a leader in Canada’s financial tech industry.

Strengthening our senior leadership team at Neo Financial

We are thrilled to share the appointment of several new senior leaders at Neo. Please join us in welcoming Amanda Broos as Chief People Officer, Dana Saric as Chief Legal Officer, Allemander Neto as Acting Chief Financial Officer, James Nauss as Chief Operating Officer, and Stefan Doan as Chief Information Officer.

Savings

View All

Bank account types: What’s the best bank account?

Which bank account is best for you? To decide that, we want to look at interest, flexibility and fees.

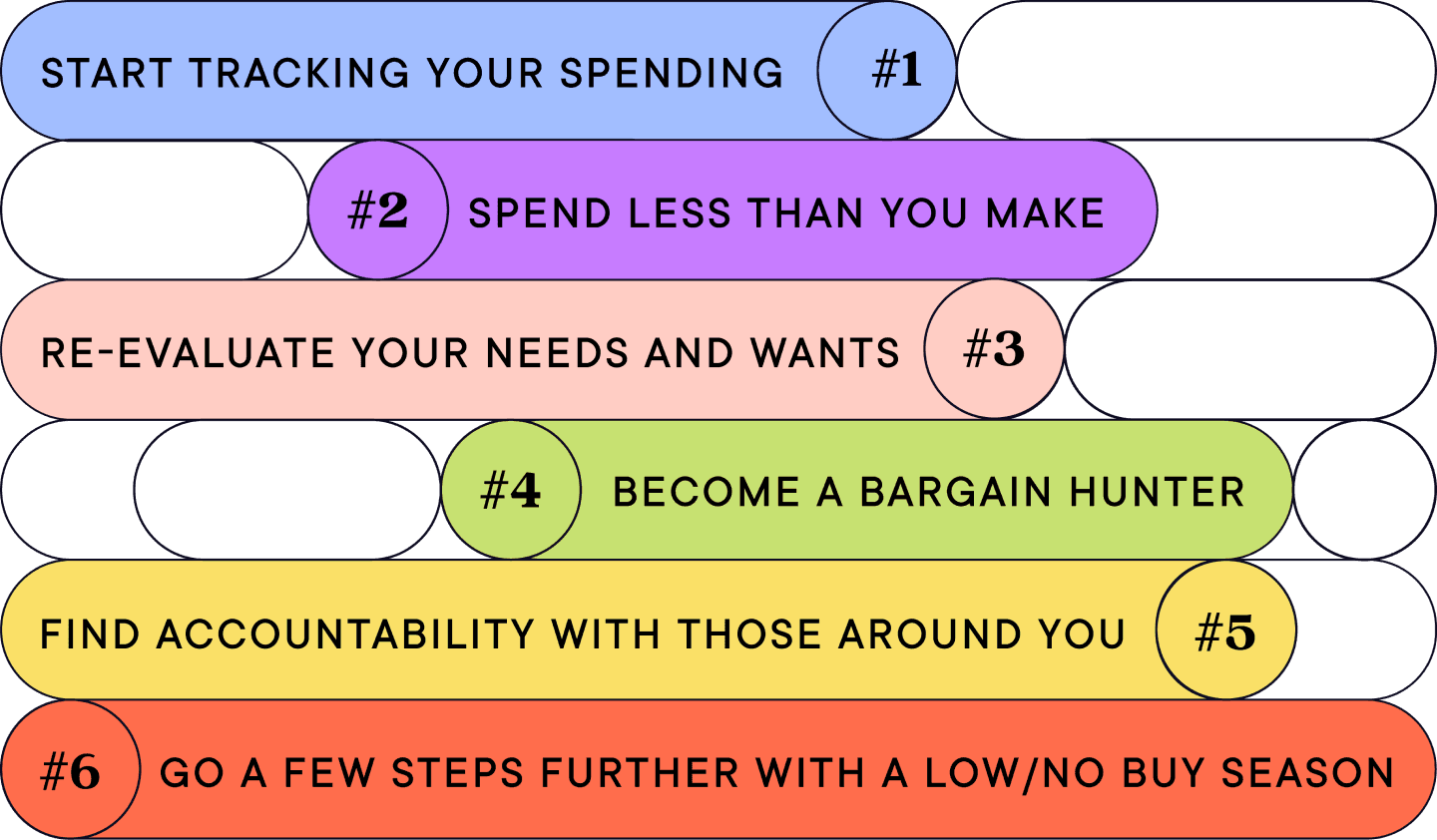

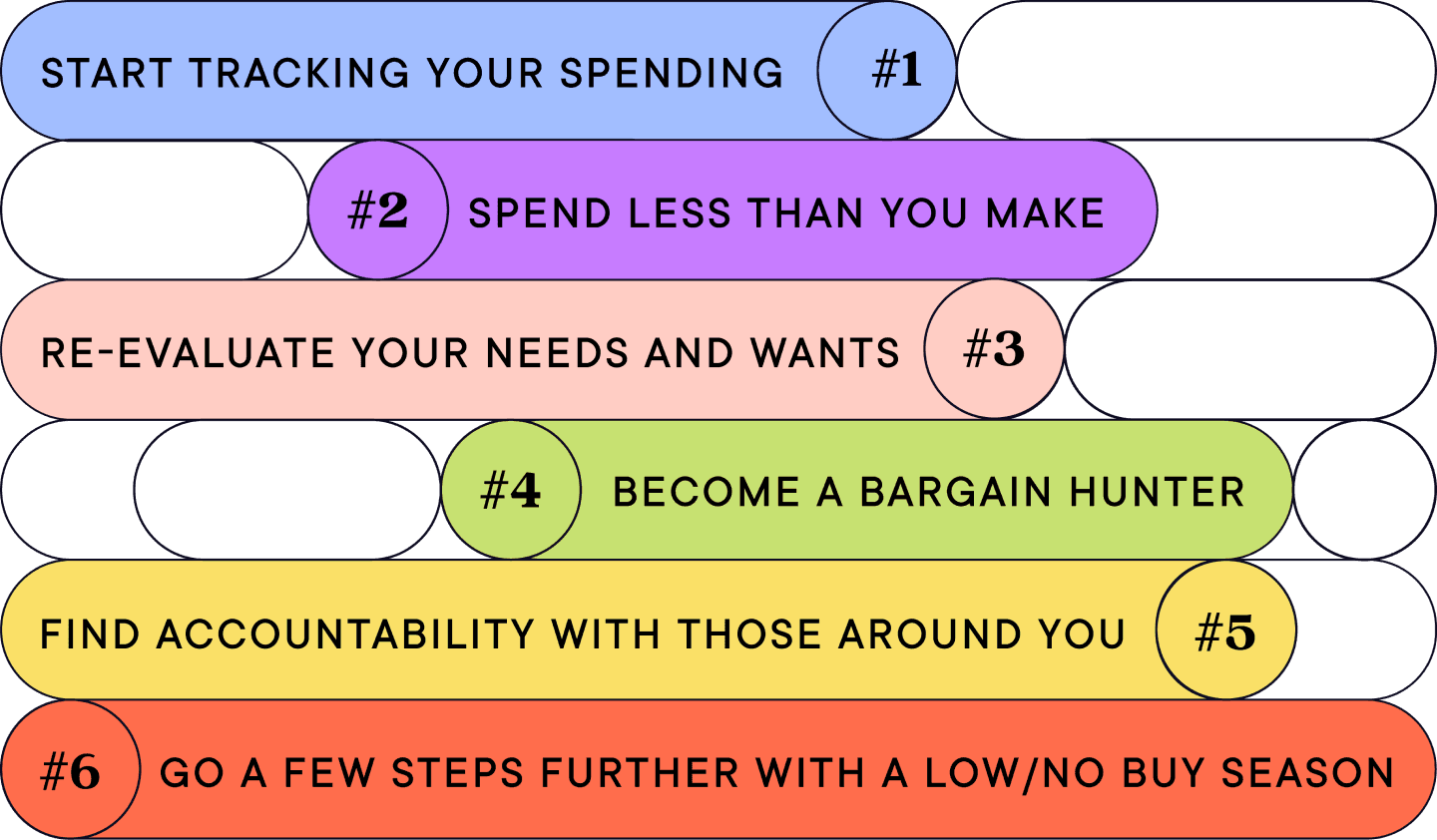

Top 6 money savings habits you can start today

Eat your avocado toast and use these top tips to save your money instead. Work on implementing these 6 money habits and change the way you view your finances.

A Guide to High-Interest Savings Account Interest Rates

Looking for high interest savings account rates? Neo Financial® offers competitive options that could help you maximize your money. Find out more today.

Bank account types: What’s the best bank account?

Which bank account is best for you? To decide that, we want to look at interest, flexibility and fees.

Top 6 money savings habits you can start today

Eat your avocado toast and use these top tips to save your money instead. Work on implementing these 6 money habits and change the way you view your finances.

A Guide to High-Interest Savings Account Interest Rates

Looking for high interest savings account rates? Neo Financial® offers competitive options that could help you maximize your money. Find out more today.