Welcome to The Get, by Neo—a new personal finance magazine for Canadians. No acronyms, just good info.

Here’s the answer to week’s reader question.

-----------------------------------------------------------------------------------

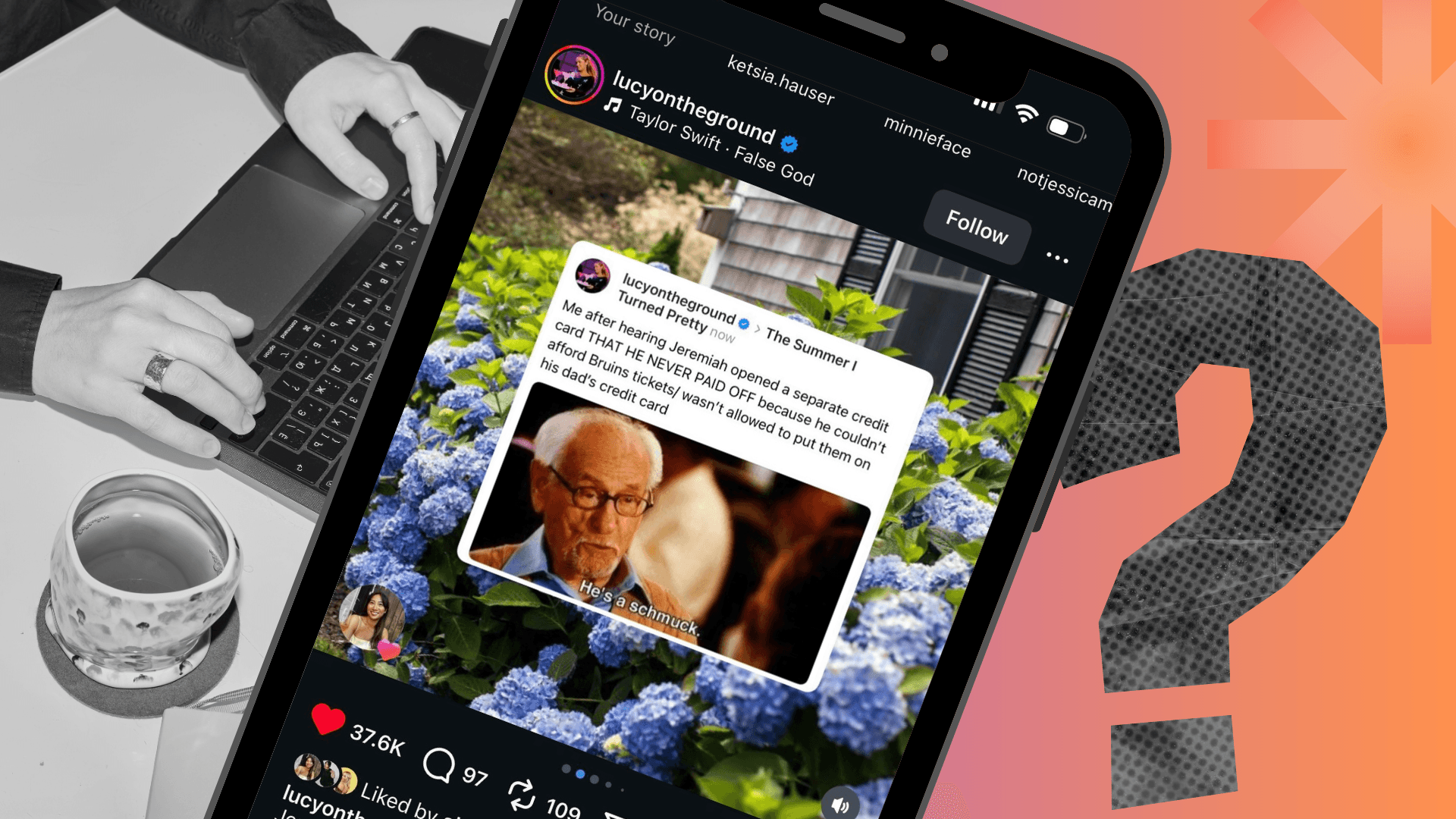

The Summer I Turned Pretty might have had Canadian viewers debating whether or not Belly should keep seeing Jeremiah and his low credit score. But what if this happens in real life?

“I just found out that the person I’m dating doesn’t have a good credit score. If we move in together or get married, will their score affect mine?”

—Shannon

Should you be concerned about your partner’s credit score?

Your credit score is yours alone. Getting married or moving in together does not merge your credit scores or reports. While your partner’s credit score won’t directly impact yours, it can become relevant if you choose to share a financial product, such as a joint credit card, loan, or mortgage. Those accounts will appear on both of your credit reports, meaning if your partner misses payments or carries high balances, it could affect your credit score. Similarly, if you co-sign a loan for your partner and they default, you’re responsible and your credit will be impacted.

That said, their past debts or bankruptcies don’t transfer to your credit file, unless you actively link your finances. Simply living together or getting married does not create a financial link between your credit profiles.

It’s important to have open conversations about money and credit habits. Transparency and planning can help protect both your financial futures.

—Matt Fabian

Director of financial services research and consulting at TransUnion Canada

Have a question for us? Send it to TheGet@neofinancial.com.

Read more from this issue of The Get:

- True or false: “Splurges are bad for your credit score.”

- The Cost of Seeing Sports Live: How much would you spend on play-off tickets

- “How did I get here?” asks Canadian comedian Rick Mercer

- Changing jobs? Negotiate a better pay rate

-----------------------------------------------------------------------------------

The Get is owned by Neo Financial, and the content it produces is for informational purposes. Any views expressed are those of the individual author and/or of The Get editorial team., not of Neo Financial or any of its partners or affiliates. The content is not meant to replace professional financial advice, and it should not be the sole source for making any financial decisions. Always do your due diligence before deciding what to do with your money. Read The Get’s editorial mandate.