Invest with experts, not just algorithms.

Combine the ease of online investing and the expertise of portfolio managers with Neo Invest™—powered by OneVest¹.

No more cookie cutter portfolios

Say goodbye to one-size-fits-all investing. Your goals, values, timelines, and risk tolerance are built into a custom portfolio designed with you at the heart of it.

Level up your online investment strategy

Get better potential returns with up to 3x more asset classes. Diversify your portfolio beyond basic stocks and bonds with alternative investments that help achieve better risk-adjusted returns.

Your money, in good hands

OneVest's portfolio managers don't like taking unnecessary risks any more than you do. They build you a diversified portfolio with multiple asset classes and investment strategies to help you achieve your investment objectives.

Got questions?

We can answer them.

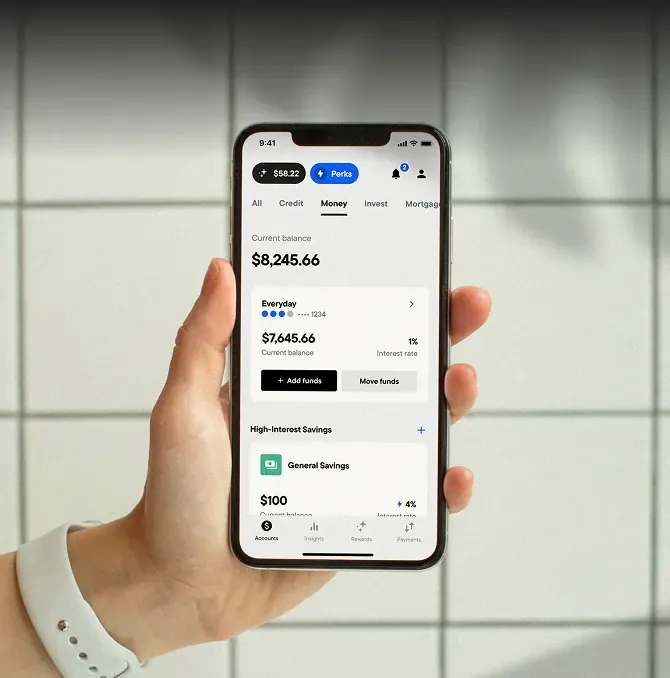

Get started with online investing in Canada today.

Set up your personalized Neo Invest™—powered by OneVest¹