By Barry Choi, award-winning personal finance and travel expert and founder of MoneyWeHave.com

As told to Ian Portsmouth

Here’s the answer to this week’s reader question.

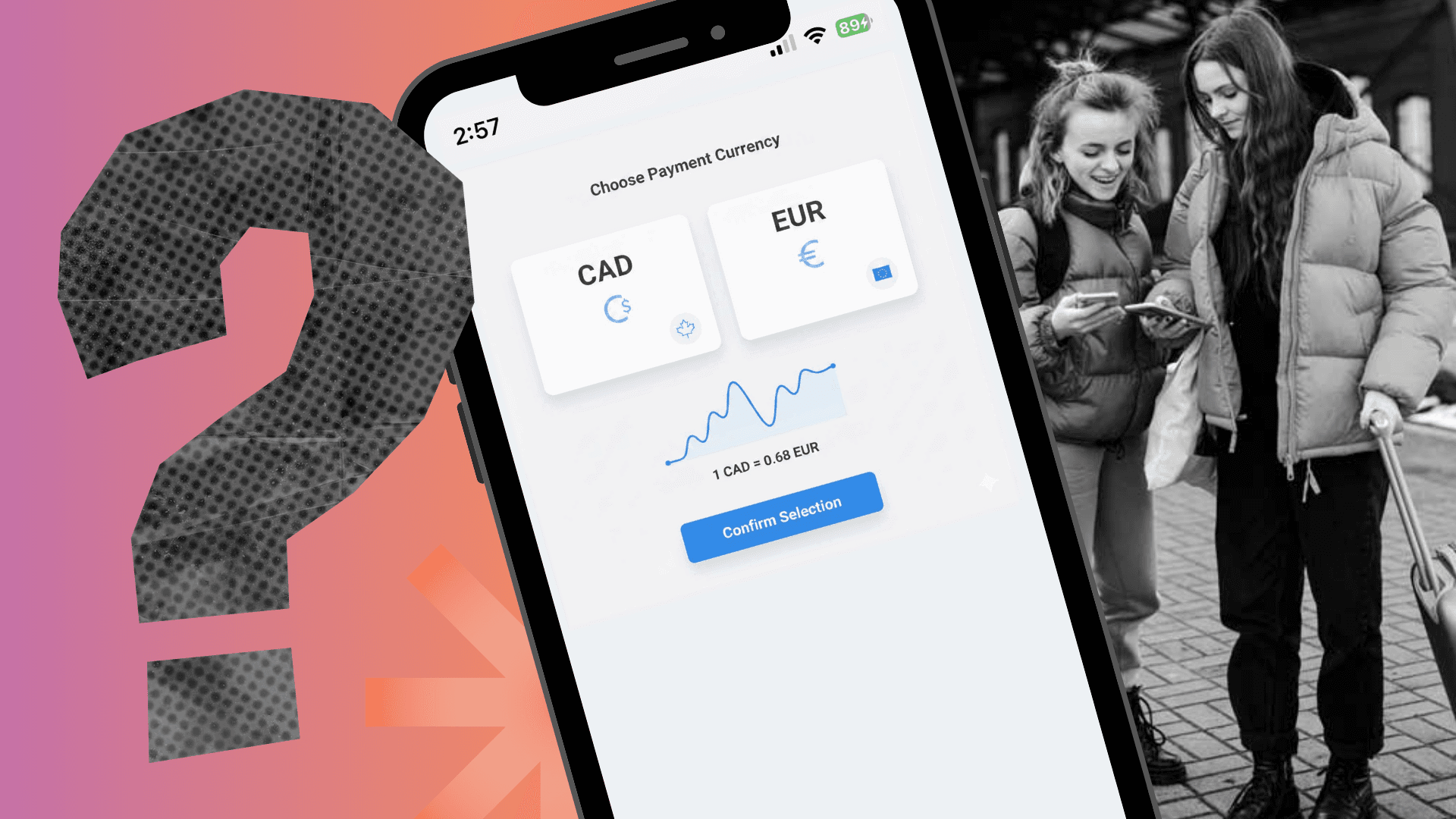

“When I travel and pay with a credit card, I’m prompted to pick a currency: Canadian dollars or the money of where I’m visiting. Which is better?”

—Diya

Should I pay in local currency or CAD on my credit card?

If you’ve used your credit card while travelling outside of Canada in recent years, you’ve probably encountered dynamic currency conversion (DCC). It’s a feature on many card machines that allows you to choose between paying in the local currency or Canadian currency.

Before DCC existed, you had to pay in the local currency—there was no other option. So, you wouldn’t find out how much you were paying in Canadian dollars until the charge appeared on your credit card statement. With DCC, now you also see the transaction amount converted to Canadian dollars before you complete the transaction. A lot of people choose the Canadian dollar option. I think that’s because it feels good to know how much you’re paying in Canadian dollars without having to remember the exchange rate and do the math in your head.

Always pay in local currency with your card

But no matter where in the world you are, you should always choose to pay in the local currency. Here’s why.

Dynamic currency conversion is a service that payment processors provide to merchants. Depending on the situation, either the payment processor or the merchant sets the currency conversion rate. Typically, it’s the wholesale exchange rate plus a markup of 3% to 10%, possibly more. In some instances, that’s better than the rate you’d pay for foreign cash at a bank or a currency exchange kiosk. But the DCC rate is always worse than the rate your credit card will apply.

The conversion rate used by credit card networks (e.g., MasterCard) is the wholesale rate plus a tiny markup, usually less than 0.5%. It’s really the lowest exchange rate that a consumer can get anywhere.

So, if you take the Canadian dollar option on the payment terminal, your final cost will be roughly 2.5% to 9.5% more than if you had taken the local currency option. That could be $0.95 on a $10 souvenir or $95 on a $1,000 hotel bill.

It’s as if the merchant is asking you, “How much would you like to pay: less or more?”

Does selecting CAD avoid foreign transaction fees?

You wouldn’t be blamed for thinking that choosing the Canadian dollar option avoids the foreign transaction fee charged by many credit cards, which is typically 2.5% of the transaction amount. But the fee is usually based on where the purchase is processed—not the currency you choose—so many issuers still apply it even when the charge appears in Canadian dollars.

To make things a bit more expensive again, the foreign transaction fee is calculated after the amount has been converted to Canadian dollars—so, if you choose the merchant’s inflated Canadian dollar option, the total foreign transaction fee will be higher than if you’d paid in the local currency.

Generally, foreign travel will be less expensive if you pay for as many expenses as possible with a credit card—especially one without foreign transaction fees—rather than cash.

Still, many merchants only accept cash, so research your travel destination in advance to figure out how much cash you’ll need and where to get the best foreign exchange rate. Depending on where you’re going, you can find a better deal abroad than you will in Canada.

Have a question for us? Send it to TheGet@neofinancial.com.

Ian Portsmouth is an award-winning writer and editor specializing in business and personal finance. He is based in Toronto.

Read more from this issue of The Get:

- How to invest in cottage real estate like a Hollander

- MVP: Game Stop: The money lessons Canadian athletes learn

- Here’s one way to reduce your grocery bill

- True or false: Buy Now, Pay Later costs nothing

-----------------------------------------------------------------------------------

The Get is owned by Neo Financial Technologies Inc. and the content it produces is for informational purposes only. Any views and opinions expressed are those of the individual authors or The Get editorial team and do not necessarily reflect the official policy or position of Neo Financial Technologies Inc. or any of its partners or affiliates.

Nothing in this newsletter is intended to constitute professional financial, legal, or tax advice, and should not be the sole source for making any financial decisions. Past performance is not a guarantee of future results. Neo Financial Technologies Inc. does not endorse any third-party views referenced in this content. Always do your due diligence before deciding what to do with your money.

© 2026 Neo Financial Technologies Inc. All rights reserved.