By Cindy Marques, certified financial planner

As told to Kelsey Rolfe.

Here’s the answer to this week’s reader question.

“How can people ensure they get the best credit product?”

–Peggy

Getting the best credit in Canada

There are different types of credit. Let’s compare them.

How to find a good credit card

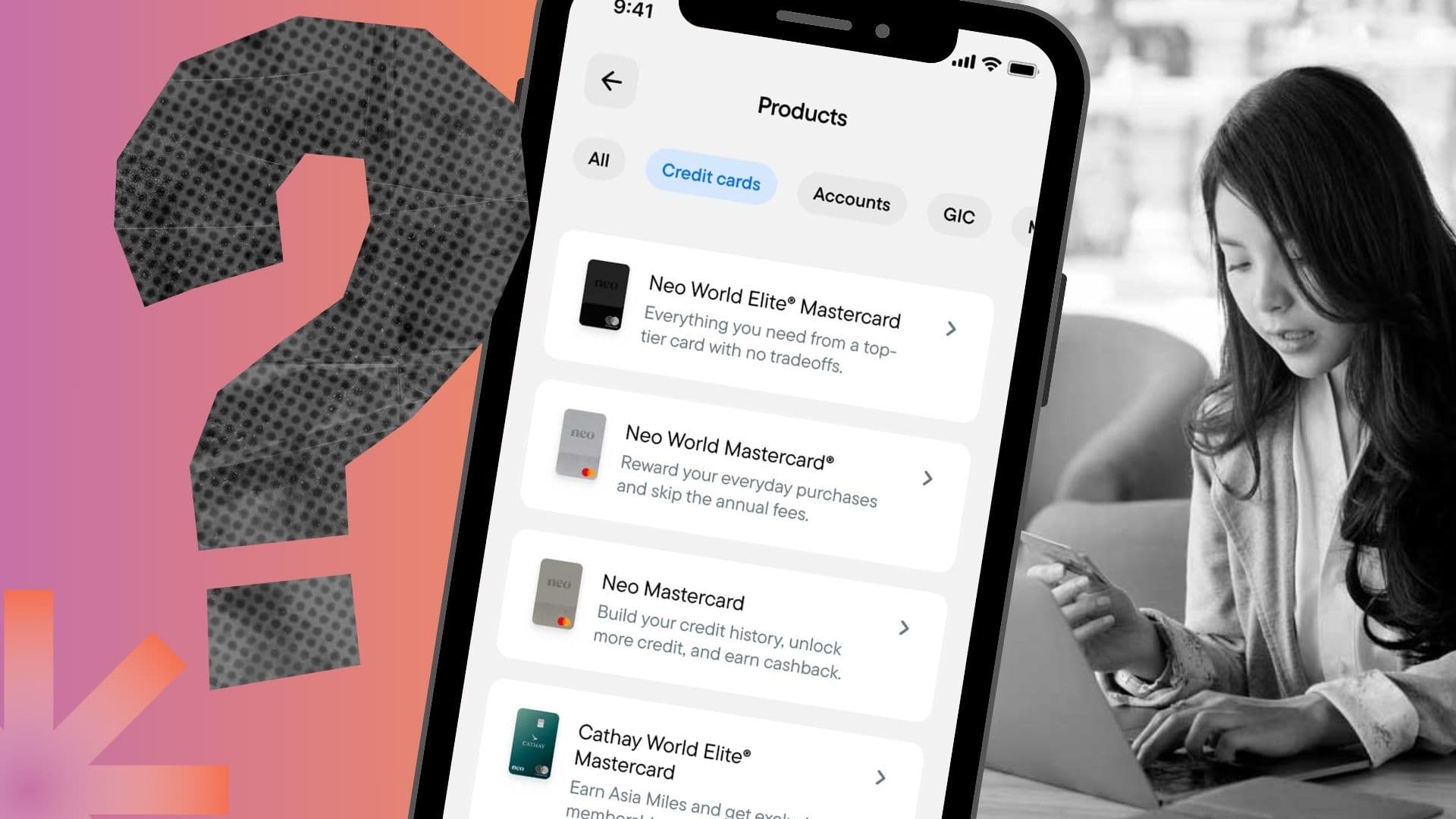

It depends on what you want from a credit card. To point yourself in the right direction, start a conversation with an AI and talk about the features you prioritize. Is it cash back? Do you want to be rewarded with dollar savings for the spending you’re doing? Are you an avid traveller looking for cards that’ll offer the best reward perks? Or is it a low interest rate? Start with what you want, and let your AI tool suggest a selection of cards.

Interest rate is really, really important, but it’s also pretty standard for cards to be around 20%. There are low-interest rate cards (around 12%). This type of card may be helpful, especially for individuals that have a lot of credit card debt. Just call your credit card provider and ask them to switch you to a lower interest rate card—your debt repayment efforts go a lot further.

As for card rewards, read the fine print, and look at what happens if you miss payments. How quickly will the card provider charge you a penalty interest rate? Is it on the first strike or after multiple strikes? And how much is the penalty rate? All these details matter and are good to know. If you need access to a balance transfer or want to be able to withdraw cash from an ATM, typically those services have different interest rates attached, which you should look at.

As a rule, always pay at least the minimum payment to avoid a negative hit on your credit score.

What to look for in a loan

If you’re looking for a personal loan or a line of credit, you can probably start the process online.

For a loan, be prepared to answer “What are you borrowing the money for?” If you’re applying for a loan with an institution that you’ve not previously had a relationship with, that answer may help make the case for a more generous loan amount.

Early repayment on a personal loan comes with costly fees or restrictions. Often with a fixed term loan (meaning you pay a fixed interest rate for the duration of the loan), you are set to a schedule of payments, which include the cost of interest, for a defined period of time until the loan is paid off at the end of that term.

If you want to make larger payments to pay it off sooner, there can be additional fees and penalties to do so. Sometimes, though, there’s an opportunity to negotiate some prepayment flexibility. The repayment you can make is often restricted to a maximum per year—a percentage of the principal or the balance, or a certain dollar limit.

With an open loan, you can make larger payments without penalty to pay off the debt sooner. However, that prepayment flexibility often comes with the trade-off of higher interest rates.

For individuals who only need financing for a short period of time and expect they can pay it off early, open loans will allow them to pay less interest overall.

Again, you can go into an AI chat, and ask questions about the type of loan you need. If you’ve banked with a certain institution for quite some time, they have an idea of who you are as a financial consumer and may automatically approve you. But you may not get the best rate at your own bank, so always shop around.

What to look for in line of credit

For lines of credit, the interest rate can change, which a lot of people may not realize. The rate is tied to the Bank of Canada’s prime rate; usually the prime plus a few percentage points. The payment schedule is up to you, and you must pay the interest owed. You can also pay off the debt and have access to that credit for as long as you have the line of credit open. But don’t overextend yourself, assuming that you’re going to be locked in at the current rate. Instead, you should assume it may go up.

Get the best credit for you

Whichever product you get, remember to use your credit responsibly: avoid using too much of the balance if you can, and aim to make at least the minimum payment every month.

Have a question for us? Send it to TheGet@neofinancial.com.

Kelsey Rolfe is an award-winning freelance journalist in Toronto. She has written for The Globe and Mail, Financial Post, Canadian Business, The Logic and others.

Read more from this issue of The Get:

- Is Ozempic worth it?

- MVP: Mike Michalowicz on paying off debt, his new book

- 3 resale experts on turning clothes into capital

- True or False: You need to be an expert to understand the economy

-----------------------------------------------------------------------------------

The Get is owned by Neo Financial Technologies Inc. and the content it produces is for informational purposes only. Any views and opinions expressed are those of the individual authors or The Get editorial team and do not necessarily reflect the official policy or position of Neo Financial Technologies Inc. or any of its partners or affiliates.

Nothing in this newsletter is intended to constitute professional financial, legal, or tax advice, and should not be the sole source for making any financial decisions. Past performance is not a guarantee of future results. Neo Financial Technologies Inc. does not endorse any third-party views referenced in this content. Always do your due diligence before deciding what to do with your money.

© 2026 Neo Financial Technologies Inc. All rights reserved.