Neo blog

Make your money work smarter with Neo Financial. Learn about saving, smart spending, credit building and more on our personal finance blog.

Recommended for you

Mike Michalowicz on paying off debt, changing money patterns and his new book

Does a finance degree guarantee boat loads of money? Nope. That’s what this author learned. And he learned how to change his financial habits, too.

3 resale experts on turning clothes into capital

Style that pays can mean money in your wallet. Find out how you can flip clothes, shoes, jewellery and more.

How can I get the best credit?

Getting the best credit for you depends on a few things. Are we talking credit card? Line of credit? Loan? Don’t worry, we’re covering them all.

“I’m poorer than my parents, now what?”

Canada’s generations all experience money differently, that’s for sure. Especially with the Great Wealth Transfer. But how do you talk to your parents about it?

What does all-inclusive mean? Is it really the cheapest way to travel?

Find out what’s included, what’s not, what Canadians love about all-inclusive resorts, what they don’t love, and the real costs of all-inclusive vacation packages.

Heather Odendaal on WFH changes and the best career advice

Connecting leaders and women is what the leader of WNORTH does, but she is looking at the bigger impact for Canadians and how they work.

Mike Michalowicz on paying off debt, changing money patterns and his new book

Does a finance degree guarantee boat loads of money? Nope. That’s what this author learned. And he learned how to change his financial habits, too.

3 resale experts on turning clothes into capital

Style that pays can mean money in your wallet. Find out how you can flip clothes, shoes, jewellery and more.

How can I get the best credit?

Getting the best credit for you depends on a few things. Are we talking credit card? Line of credit? Loan? Don’t worry, we’re covering them all.

“I’m poorer than my parents, now what?”

Canada’s generations all experience money differently, that’s for sure. Especially with the Great Wealth Transfer. But how do you talk to your parents about it?

What does all-inclusive mean? Is it really the cheapest way to travel?

Find out what’s included, what’s not, what Canadians love about all-inclusive resorts, what they don’t love, and the real costs of all-inclusive vacation packages.

Heather Odendaal on WFH changes and the best career advice

Connecting leaders and women is what the leader of WNORTH does, but she is looking at the bigger impact for Canadians and how they work.

Credit

View All

How to build credit: Grow your credit profile in Canada

Learn practical steps to help build your credit score, understand how credit works, and take control of your financial path in Canada with confidence.

How to boost your credit score fast

Is your credit score causing you to be charged higher rates on your car loan or making it harder to qualify for a credit card? It’s time for a change.

A 90-day guide to building your financial foundation for newcomers

Moving to Canada is exciting — the opportunities, new communities. And let’s be honest, it’s a lot of paperwork, but getting your finances set up can be quick. With today’s digital banking and fintech options, it’s easier than ever to take control of your money.

How to build credit: Grow your credit profile in Canada

Learn practical steps to help build your credit score, understand how credit works, and take control of your financial path in Canada with confidence.

How to boost your credit score fast

Is your credit score causing you to be charged higher rates on your car loan or making it harder to qualify for a credit card? It’s time for a change.

A 90-day guide to building your financial foundation for newcomers

Moving to Canada is exciting — the opportunities, new communities. And let’s be honest, it’s a lot of paperwork, but getting your finances set up can be quick. With today’s digital banking and fintech options, it’s easier than ever to take control of your money.

Spending

View All-noZ7EWjRU9dKiBNDc0ZBel0LonqVUs.png&w=1920&q=75)

Why the holidays are the season for scams—and how to avoid them

Don’t become a victim; be aware of common holiday scams. It may help you protect yourself, your sensitive information and your money.

How do credit cards work? The ultimate credit card guide for beginners

Everything from applications and utilization to limits and payments

What is inflation and whats next?

Inflation is a daunting topic that brings many unpleasant feelings. We’re here to help you understand what inflation is, what to look out for, and what you can do.

-noZ7EWjRU9dKiBNDc0ZBel0LonqVUs.png&w=1920&q=75)

Why the holidays are the season for scams—and how to avoid them

Don’t become a victim; be aware of common holiday scams. It may help you protect yourself, your sensitive information and your money.

How do credit cards work? The ultimate credit card guide for beginners

Everything from applications and utilization to limits and payments

What is inflation and whats next?

Inflation is a daunting topic that brings many unpleasant feelings. We’re here to help you understand what inflation is, what to look out for, and what you can do.

Budgeting & Debt

View All

Neo’s declassified financial survival guide for your 20s

Find answers to your top questions about personal finance in your 20s. We focus on the top 9 goals you should aim for to set yourself up for success

Understanding debt

Learn simple, straightforward debt management strategies that will enable you to fully understand and manage your debt, while providing you with peace of mind.

How Much Money Should I Have Saved by 30?

Not sure how much money you should have saved by the time you're 30? We give you tips and advice on budgeting, saving, and building wealth. Get started today!

Neo’s declassified financial survival guide for your 20s

Find answers to your top questions about personal finance in your 20s. We focus on the top 9 goals you should aim for to set yourself up for success

Understanding debt

Learn simple, straightforward debt management strategies that will enable you to fully understand and manage your debt, while providing you with peace of mind.

How Much Money Should I Have Saved by 30?

Not sure how much money you should have saved by the time you're 30? We give you tips and advice on budgeting, saving, and building wealth. Get started today!

New from Neo

View All

3 tips for first-time homebuyers in 2023

Reduce stress when buying your first home by better understanding the process, and use these three tips from Treadstone Law to reach homeownership like a pro.

Neo Financial Teams Up with CEBL

The Canadian Elite Basketball League (CEBL) is partnering up with Neo Financial™, a leader in Canada’s financial tech industry.

Strengthening our senior leadership team at Neo Financial

We are thrilled to share the appointment of several new senior leaders at Neo. Please join us in welcoming Amanda Broos as Chief People Officer, Dana Saric as Chief Legal Officer, Allemander Neto as Acting Chief Financial Officer, James Nauss as Chief Operating Officer, and Stefan Doan as Chief Information Officer.

3 tips for first-time homebuyers in 2023

Reduce stress when buying your first home by better understanding the process, and use these three tips from Treadstone Law to reach homeownership like a pro.

Neo Financial Teams Up with CEBL

The Canadian Elite Basketball League (CEBL) is partnering up with Neo Financial™, a leader in Canada’s financial tech industry.

Strengthening our senior leadership team at Neo Financial

We are thrilled to share the appointment of several new senior leaders at Neo. Please join us in welcoming Amanda Broos as Chief People Officer, Dana Saric as Chief Legal Officer, Allemander Neto as Acting Chief Financial Officer, James Nauss as Chief Operating Officer, and Stefan Doan as Chief Information Officer.

Savings

View All

Bank account types: What’s the best bank account?

Which bank account is best for you? To decide that, we want to look at interest, flexibility and fees.

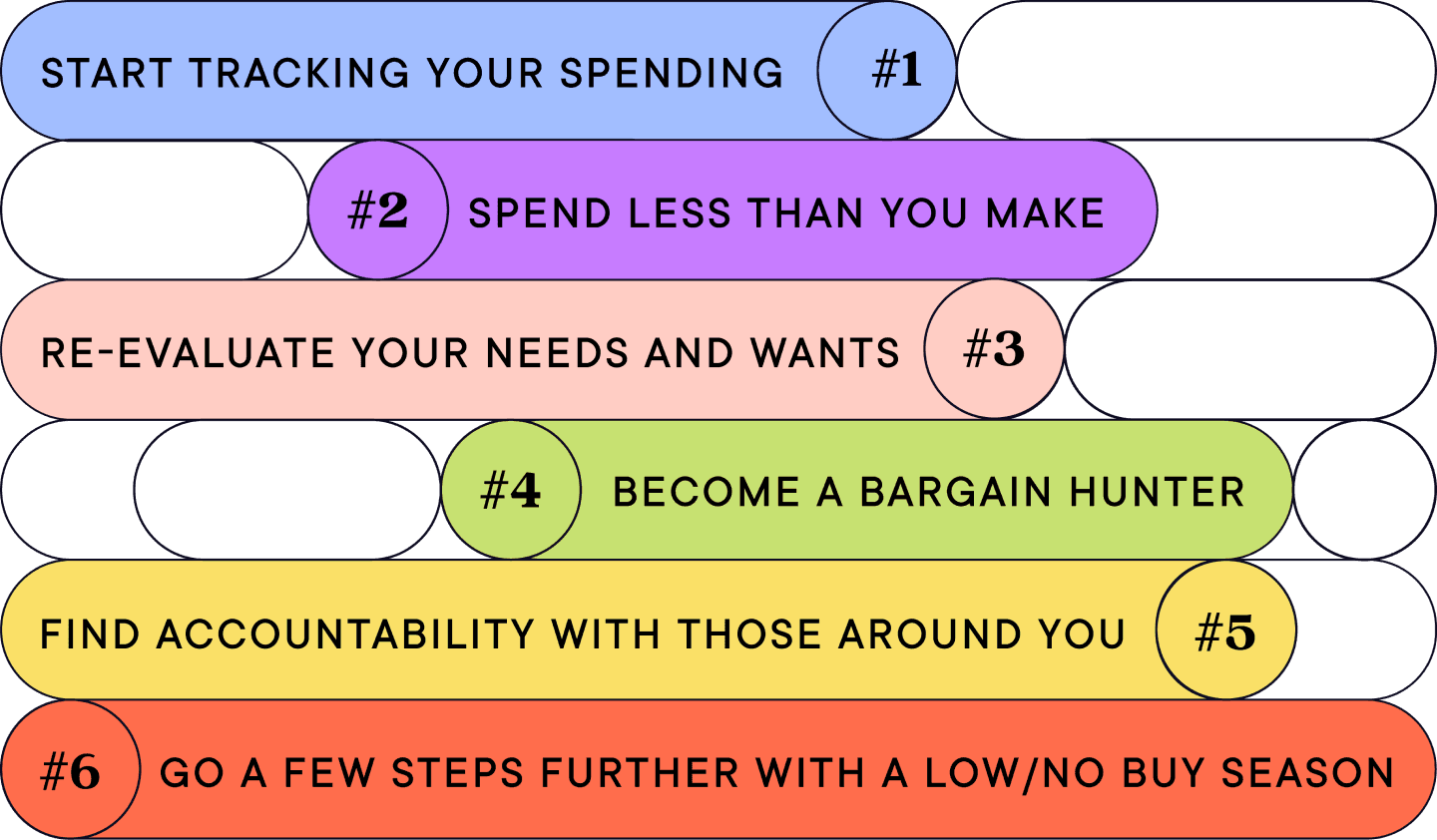

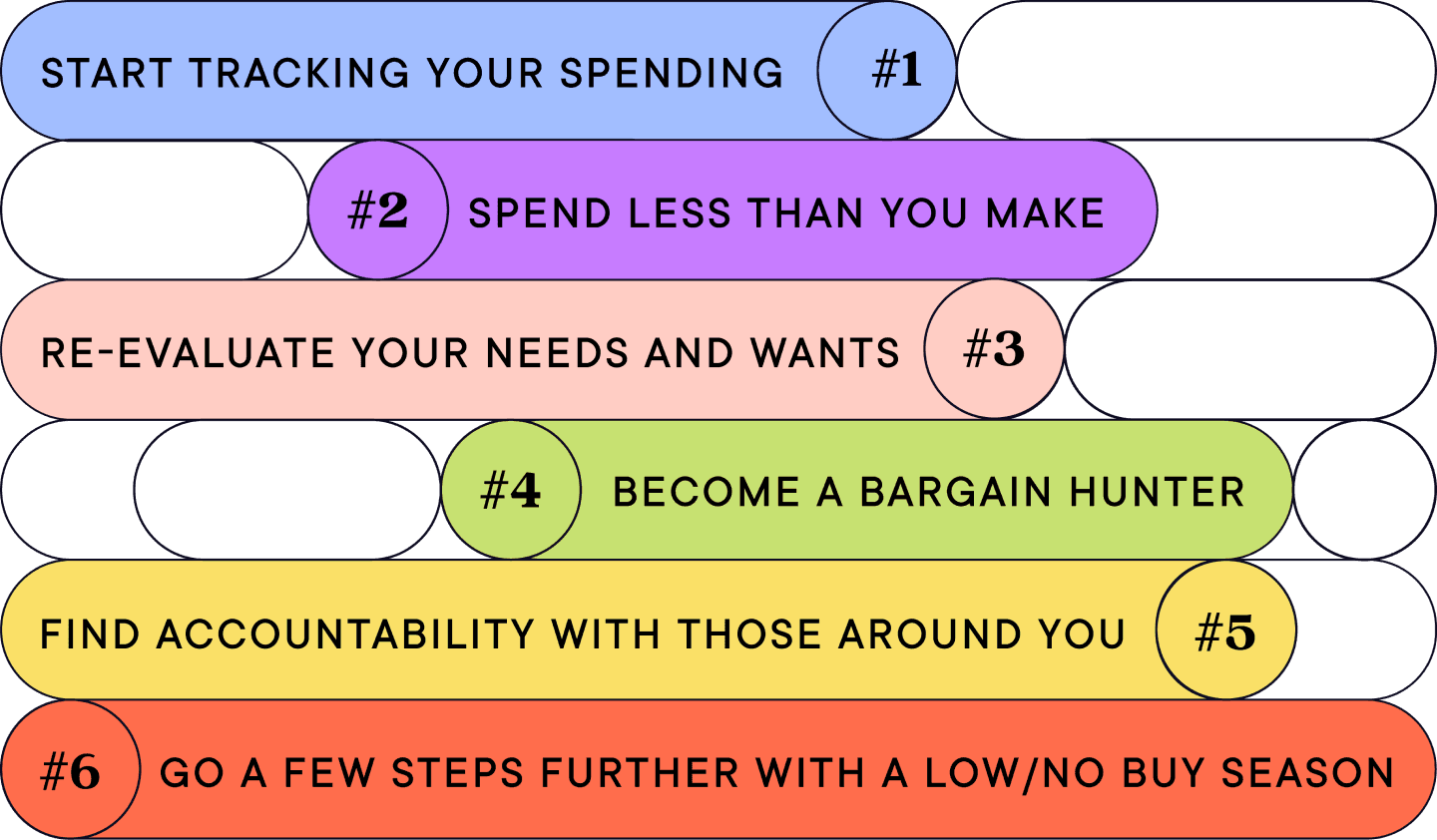

Top 6 money savings habits you can start today

Eat your avocado toast and use these top tips to save your money instead. Work on implementing these 6 money habits and change the way you view your finances.

A Guide to High-Interest Savings Account Interest Rates

Looking for high interest savings account rates? Neo Financial® offers competitive options that could help you maximize your money. Find out more today.

Bank account types: What’s the best bank account?

Which bank account is best for you? To decide that, we want to look at interest, flexibility and fees.

Top 6 money savings habits you can start today

Eat your avocado toast and use these top tips to save your money instead. Work on implementing these 6 money habits and change the way you view your finances.

A Guide to High-Interest Savings Account Interest Rates

Looking for high interest savings account rates? Neo Financial® offers competitive options that could help you maximize your money. Find out more today.