Canada’s first card that grows with you.

Start today and get approved instantly¹. We’ll help you build your credit history and borrow better.

One card. Two ways to start.

You’ll be offered a traditional card or a card with a secured credit limit, depending on your credit history.

Traditional credit card

If you qualify for credit today, you’ll get an offer for a Neo Mastercard with a credit limit up to $10,000.

Card with secured credit limit

If you’re starting out or rebuilding credit, you’ll get an offer for a Neo Mastercard with a secured credit limit so you can build your credit history.

Requires refundable security funds³ and the Build membership ($7.99/month, with ways to get it for free) to get features to help strengthen your credit.

Check before you apply

Explore what you're pre-approved for with no hard credit check.

Flexible credit that grows

Build your credit history and work towards higher credit limits.

- Start where you are today

Apply with any credit history or income.

- Unlock more credit

You can be eligible for higher limits in as little as 3 months.

- Accelerate your growth

The Build membership can help you build your credit history faster.

Top features of the Neo Mastercard

Instant virtual card

Start spending before your physical card arrives.

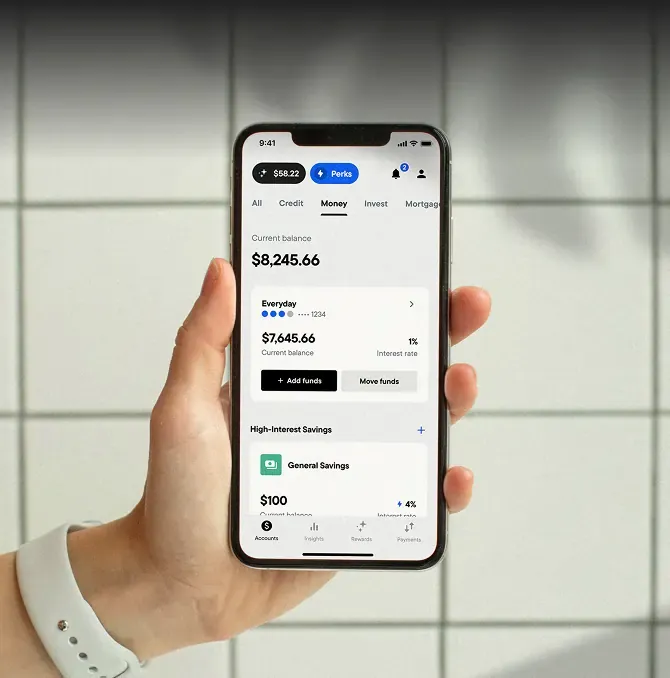

Manage your card online

Freeze your card, check your PIN, and track spending.

1% cashback⁴ from gas and grocery

Rewards for your everyday essentials.

Cashback offers

Shop at over 10,000 partners across Canada to earn cashback⁵.

Add an additional cardholder

Share access with a partner, family member, or anyone you trust⁶.

Auto-Pay

Set it and forget it with automatic payments.

Stay safer with next-gen card protection

Every Neo Mastercard comes with advanced technologies to protect your privacy and help prevent unauthorized purchases.

- Real-time alerts

Get notified when your card is used so you’ll never find a surprising purchase on your statement.

- Advanced fraud monitoring

Neo uses AI to monitor for unusual activity while keeping your personal data private.

- Mastercard Zero Liability

Help protect your card from purchases that you didn’t make⁷.

Customize your card experience

Add a Neo membership

Level up all of your Neo products and unlock premium features, credit tools, and higher savings interest rates.

Protect your balance

Balance protection is optional coverage⁸ that can help cover your payments during tough times.

Have a question?

Here’s some common questions about the Neo Mastercard.

Not sure this is your card?

Explore what you’re pre-qualified for with no hard credit check.